In an era where digital transactions reign supreme, businesses need to adapt and offer convenient payment options to their customers. Revolut, a disruptive financial technology company, has emerged as a game-changer in the world of online payments. With its innovative platform and comprehensive suite of services, Revolut empowers businesses to accept card payments online in a seamless and cost-effective manner.

In this article, we will explore how Revolut enables businesses to tap into the immense potential of online card payments, revolutionizing the way transactions are conducted and enhancing the overall customer experience.

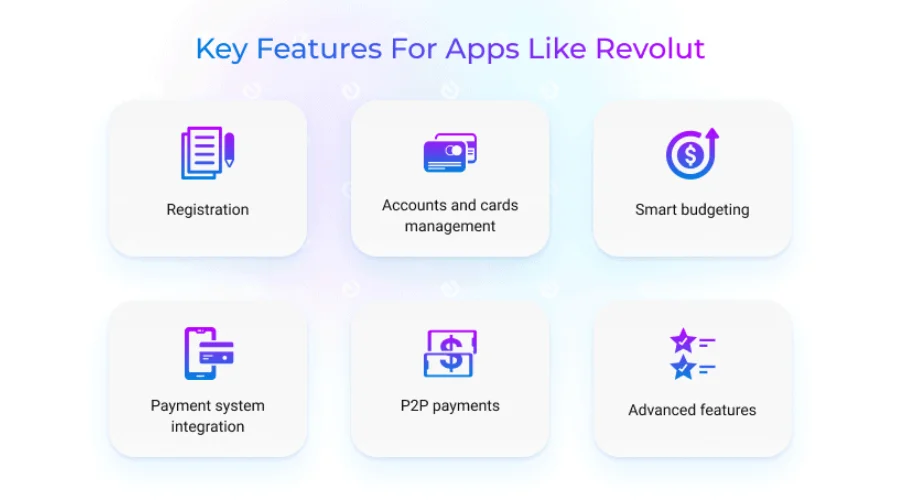

Key Features and Benefits of Revoult

Revolut has gained significant popularity as a digital banking alternative, but its impact on accept card payments online cannot be overlooked. By harnessing the power of technology and disrupting traditional financial systems, Revolut has created a platform that simplifies payment processing and opens doors to a global customer base.

Whether you run a small e-commerce store, provide professional services, or manage a large enterprise, Revolut offers a range of features and benefits that make accepting card payments online both efficient and accessible.

Streamlined Integration and Setup

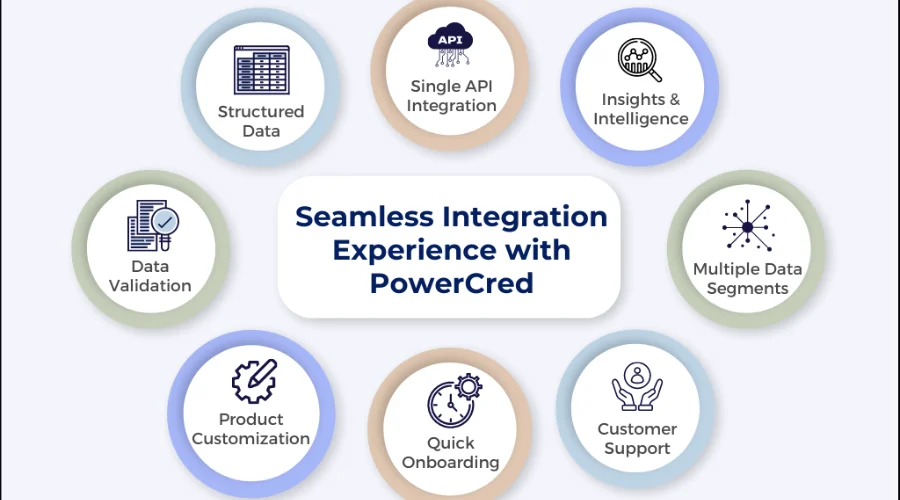

One of the key advantages of using Revolut for online payment acceptance is its streamlined integration process. With Revolut’s developer-friendly APIs and extensive documentation, businesses can seamlessly integrate their platforms with Revolut’s payment infrastructure. Whether you have an existing website or are starting from scratch, integrating Revolut’s payment gateway can be done with relative ease. This ensures a quick setup process, enabling businesses to start accepting card payments online in no time.

Global Reach and Multi-Currency Support

Revolut’s global presence allows businesses to expand their reach beyond borders. With the ability to accept payments in multiple currencies, businesses can tap into international markets and cater to customers around the world. Revolut’s multi-currency accounts and competitive foreign exchange rates make cross-border transactions seamless and cost-effective. This not only enhances the customer experience but also opens doors to new revenue streams for businesses of all sizes.

Robust Security and Fraud Prevention

Security is a paramount concern when it comes to accepting card payments online. Revolut takes this aspect seriously and provides robust security measures to protect businesses and their customers. With advanced encryption protocols and two-factor authentication, Revolut ensures that sensitive payment data remains secure throughout the transaction process. Additionally, Revolut’s AI-powered fraud detection system helps identify and prevent fraudulent activities, minimizing risks for businesses.

Comprehensive Reporting and Analytics

Understanding transaction data and gaining valuable insights is crucial for business growth. Revolut provides businesses with comprehensive reporting and analytics tools that offer real-time visibility into sales, revenue, and customer behaviour. By harnessing this data, businesses can make informed decisions, optimize their online payment strategies, and drive revenue growth.

Seamless Integration with Business Accounts

Revolut’s integration with business accounts further simplifies financial management for businesses. With Revolut Business, businesses can seamlessly manage their incoming and outgoing payments, streamline expense tracking, and gain a holistic view of their finances. This integration eliminates the need for separate banking and payment processing solutions, making financial management more efficient and convenient.

How to get started with Revoult?

Download the Revolut App: Start by downloading the Revolut app from the App Store or Google Play Store. It is available for both iOS and Android devices. You can also visit the official website of Revoult.

Create an Account: Open the app and sign up for a new account. You can choose between a personal account or a business account, depending on your needs.

Provide Basic Information: Enter your personal or business information as prompted by the app. This may include your name, email address, phone number, and business details if applicable.

Verify Your Identity: Revolut has a Know Your Customer (KYC) process in place to verify your identity. Follow the on-screen instructions to provide the required identification documents. This usually involves uploading a photo of your ID or passport and taking a selfie.

Choose Your Plan: Revolut offers different plans with varying features and benefits. Select the plan that best suits your needs. They typically include a free plan and premium plans with additional features for a monthly fee.

Set Up Your Account: Once your account is created, you can start customizing your preferences. Set up your preferred currency, enable features like budgeting tools and savings accounts, and link your bank accounts or cards for easy transfers.

Top Up Your Account: To start using Revolut for payments, you’ll need to top up your account. You can do this by linking your existing bank account or card and transferring funds to your Revolut account. Alternatively, you can use the in-app option to add money.

Explore the Features: Familiarize yourself with the features and functionalities of the Revolut app. This includes managing your finances, making payments, exchanging currencies, setting budgets, and accessing additional services like insurance or investments.

Start Accepting Payments: Once your Revolut account is funded, you can start to accept card payments online. Revolut provides you with payment gateway integration options and APIs that you can use to seamlessly integrate their payment infrastructure into your online platform.

Conclusion

Revolut has transformed the landscape of online payment acceptance, enabling businesses to accept credit card payments seamlessly, securely, and efficiently. By offering streamlined integration, global reach, robust security, comprehensive reporting, and seamless integration with business accounts, Revolut empowers businesses of all sizes to leverage the power of online payments and expand their customer base. As the world continues to embrace digital transactions, partnering with Revolut positions businesses at the forefront of the evolving payment landscape, unlocking new opportunities for growth and success. For more information, visit Trending Cult.