In the context of our swiftly advancing digital era, the need for secure and convenient payment methods has significantly heightened for both businesses and customers. The emergence of electronic commerce and the growing use of mobile devices in facilitating transactions have sparked the development of novel payment systems. One potential option that can be considered is the implementation of a secure payment link.

Prior to exploring safe payment links, it is imperative to comprehend the contextual background and the evolutionary trajectory of payment mechanisms. In recent times, there has been a notable shift in payment methods, with a progression from traditional cash transactions to the utilization of card payments.

Subsequently, the advent of internet banking, mobile wallets, and contactless payments has further expanded the range of available options. The aforementioned modifications are indicative of the increasing societal demand for enhanced efficiency, convenience, and security in the realm of financial transactions.

Understanding the Secure Payment Link:

1.1. Definition

A digital technology known as a secure payment link enables companies and people to send and receive money via a special, one-time link.

1.2. How it Works

Generation of the Payment Link:

Secure payment links are generated by the payer using a secure payment platform or app. This platform typically integrates with a user’s bank account, credit card, or other financial resources.

Customization and Amount Specification:

In addition to stating the payment amount, the payer occasionally provides a reference or description of the transaction. This enables some customisation to fit the payment’s intended use.

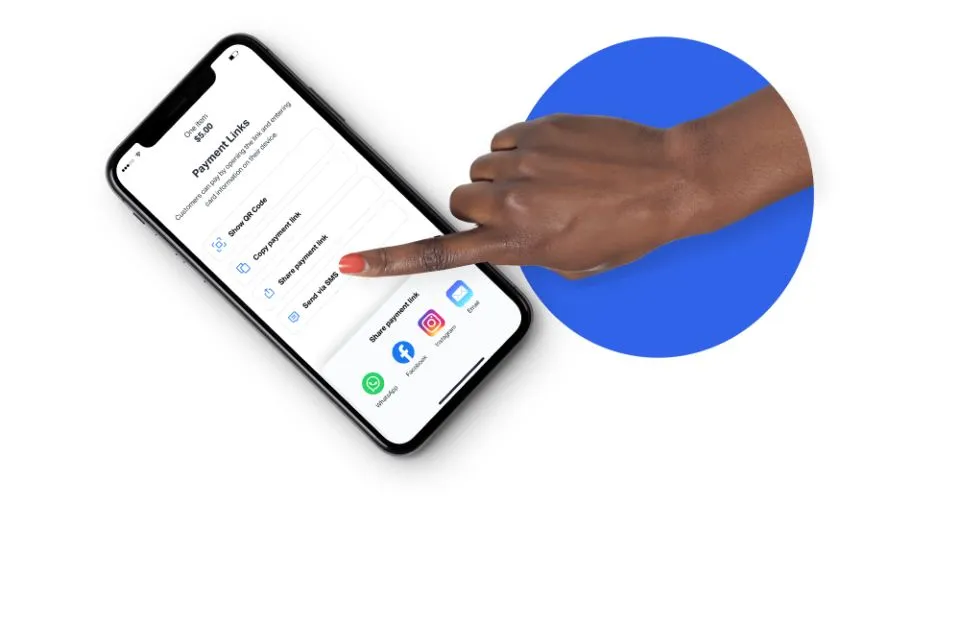

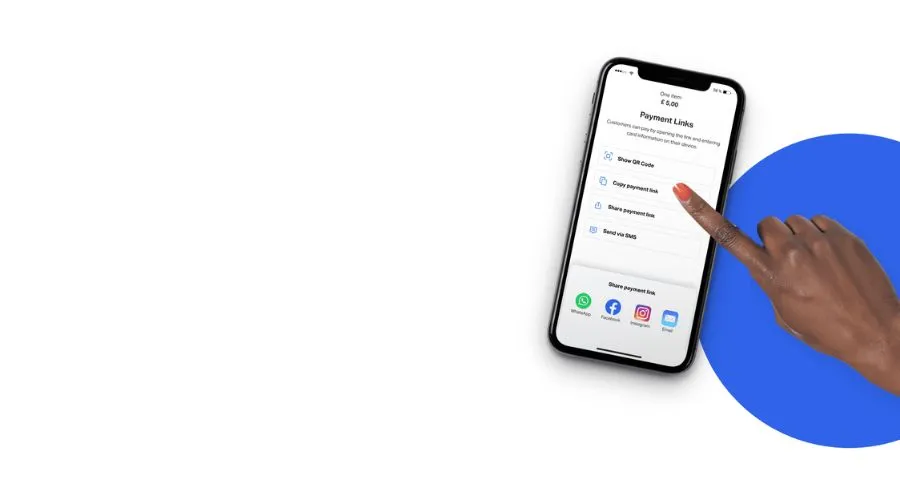

Sending the Link:

After setting up the payment information, the user creates the payment link and delivers it to the recipient via text message, email, or other messaging services.

Payment to receiver:

After clicking the link, the receiver is taken to a secure payment channel. Here, consumers input their payment information, and the transaction is handled safely by a reputable payment processor or their bank.

Security Measures in Secure Payment Links

I. Encryption and Data Protection:

Encryption forms the foundation of secure payment links. It is the process of converting sensitive information into unreadable code, which can only be deciphered by authorized recipients.

II. Tokenization:

Tokenization is another important security measure used in secure payment links. When users make payments, their credit card information is replaced with a token – a randomized set of characters. The token is used for the transaction, and the real card info is kept safe on a highly secure server. It is nearly hard for a hacker to reverse-engineer the token into the original credit card information, even if they manage to obtain access to it.

III. Regular Security Audits and Updates:

It takes constant work to keep secure payment links secure. Payment service providers carry out vulnerability assessments and security audits on a regular basis to find and fix any possible flaws in their systems. Regular updates and patches are applied to ensure that the system remains resilient against evolving threats.

IV. Compliance with Regulations:

Additionally, secure payment links need to go by a number of legal regulations and standards. To handle credit card information securely, for instance, the Payment Card Industry Data Security Standard (PCI DSS) establishes requirements. It is essential to follow these guidelines in order to guarantee the security of payment links.

Key Benefits of Secure Payment Links

I. Enhanced Security:

Security is a major benefit of secure payment links. Traditional payment methods like phone or email credit card sharing are subject to fraud and data breaches. Encryption makes sensitive data difficult to access or intercept in secure payment lines. This makes transactions safe for businesses and customers, eliminating financial fraud and identity theft.

II. Convenience and Accessibility:

Secure payment links offer unparalleled convenience to both customers and businesses. It is no longer necessary for users to swap tangible payment methods or conduct in-person transactions because they may access these links from almost anywhere with an internet connection. The payment process is streamlined and made simple and quick by this accessibility. Moreover, it allows businesses to cater to a global audience, as customers from different geographic locations can easily make payments through these links.

III. Seamless Integration:

Another key benefit of secure payment links is their compatibility with various payment methods and platforms. These links can easily interact with a variety of payment methods, including credit cards, debit cards, mobile wallets, and even cryptocurrencies. Companies are free to select the payment options that best fit their operations and customer base, giving their clients freedom and convenience.

IV. Reduced Payment Processing Costs:

For businesses, reducing payment processing costs is a crucial aspect of financial efficiency. Secure payment links can contribute significantly to cost reduction. Unlike traditional payment methods that may incur transaction fees, secure payment links can offer competitive pricing models. Additionally, they reduce the administrative overhead associated with manual payment processing, saving businesses both time and money.

V. Improved Customer Experience:

Customers no longer need to navigate complicated checkout processes or fill out extensive forms. A simple click on a secure payment link takes them to a secure payment page, where they can quickly complete their transactions, resulting in higher customer satisfaction and loyalty.

VI. Real-time Confirmation and Notifications:

Secure payment links provide real-time confirmation of transactions and notifications to both businesses and customers. This instant feedback helps in maintaining transparency and trust in the payment process. Businesses can easily track payments and reconcile accounts, while customers receive immediate receipts and order confirmations, reducing uncertainties and disputes.

Conclusion

A ground-breaking payment technique that meets the demands of contemporary consumers for efficiency, security, and convenience in financial transactions is the use of secure payment links. These links are likely to become increasingly more common as the digital landscape develops further. They are a potential alternative for both individuals and businesses because of their strong security features and smooth connection with current banking and financial systems. In our increasingly digital environment, secure payment links promise to be a more convenient, safe, and adaptable way to handle payments. For more information about online money payment links visit the official website of Trendingcult.