Revolut, a leading global financial technology company, has revolutionized the way people manage their money with its innovative digital banking services. Among its impressive range of financial products, the Revolut Travel Card stands out as a game-changer for frequent travellers and globetrotters. The Travel Card is a cutting-edge prepaid debit card specifically designed to make international travel seamless, convenient, and cost-effective. With its unique features and benefits, it has quickly gained popularity among travellers who seek a hassle-free and secure way to manage their finances abroad. One of the standout advantages of the Travel Card is its ability to hold multiple currencies. Gone are the days of worrying about foreign exchange rates or carrying large amounts of cash. The card allows users to load and store up to 28 different currencies, making it ideal for those venturing across multiple countries or planning to switch between currencies effortlessly.

Moreover, Revolut’s Travel Card provides users with real-time exchange rates at interbank rates, ensuring transparency and eliminating hidden fees often associated with traditional banks or currency exchange bureaus. This feature alone can save travellers a significant amount of money, as they can spend, transfer, or exchange money at the fairest rates available. Read the following article to learn more about the Revolut travel card, Revolut card for travel and Revolut prepaid travel card.

The Power of the Revolut Travel Card: A World of Currencies at Your Fingertips

The Revolut Travel Card is a prepaid debit card specifically designed to make international travel hassle-free and efficient. One of its standout features is its ability to hold multiple currencies. With support for up to 28 different currencies, the Travel Card allows you to load and store funds in various currencies, eliminating the need for carrying cash or worrying about unfavourable exchange rates. Whether you’re exploring the vibrant streets of Tokyo or enjoying the breathtaking landscapes of Europe, the Travel Card ensures you have access to the right currency at the right time, making your transactions seamless and cost-effective.

Unleashing the Power of Exchange Rates: Real-Time Rates at Your Fingertips

When it comes to exchanging currencies, traditional banks and currency exchange bureaus often charge high fees and provide unfavourable exchange rates. However, with the Travel Card, you can bid farewell to these unnecessary expenses. Revolut provides real-time exchange rates at interbank rates, offering you the fairest rates available in the market. This means you can spend, transfer, or exchange money without worrying about hidden fees or unfavourable rates. With the Revolut Travel Card, you have the power to maximize the value of your funds, saving money for the experiences that truly matter.

The Revolut App: Your Gateway to Seamless Financial Management

To complement the Revolut Travel Card, Revolut offers a powerful mobile app that serves as your financial hub on the go. The app provides a comprehensive suite of features to enhance your travel experience. With the Revolut app, you can easily manage your Travel Card, track your spending, set budgets, and receive real-time notifications for every transaction made. The app empowers you to stay in control of your finances, make informed decisions and adapt to your travel needs. With just a few taps on your smartphone, you can freeze or unfreeze your card, transfer money to other Revolut users instantly, and access a range of other convenient features.

Ensuring Your Financial Security: Robust Security Features of the Revolut Travel Card

When it comes to financial transactions, security is paramount. Revolut understands this and prioritizes the safety of your funds. The Revolut Travel Card comes equipped with advanced security features to provide you with peace of mind during your travels. Location-based security allows you to enable or disable card usage in specific regions, giving you complete control over where your card can be used. In the unfortunate event of card loss or theft, you can instantly block your card through the app, preventing unauthorized access and safeguarding your finances. With the Travel Card, you can explore the world with confidence, knowing that your money is protected at all times.

Getting Started with the Revolut Travel Card: Your Journey Begins Here

Obtaining and utilizing the Revolut Travel Card is a straightforward process. Let’s walk through the step-by-step guide to help you unlock the full potential of this groundbreaking financial tool.

Step 1: Download the Revolut App and Sign Up for an Account

To embark on your journey with the Revolut Travel Card, start by downloading the Revolut app from the App Store or Google Play Store. Once downloaded, follow the on-screen instructions to sign up for a Revolut account. The registration process requires basic information such as your name, email address, and phone number.

Step 2: Verify Your Identity for Added Security

To ensure compliance with regulatory standards and enhance security, Revolut may request identity verification. This typically involves submitting a photo of your identification document, such as a passport or driver’s license, and taking a selfie. The app will guide you through the process, making it quick and seamless.

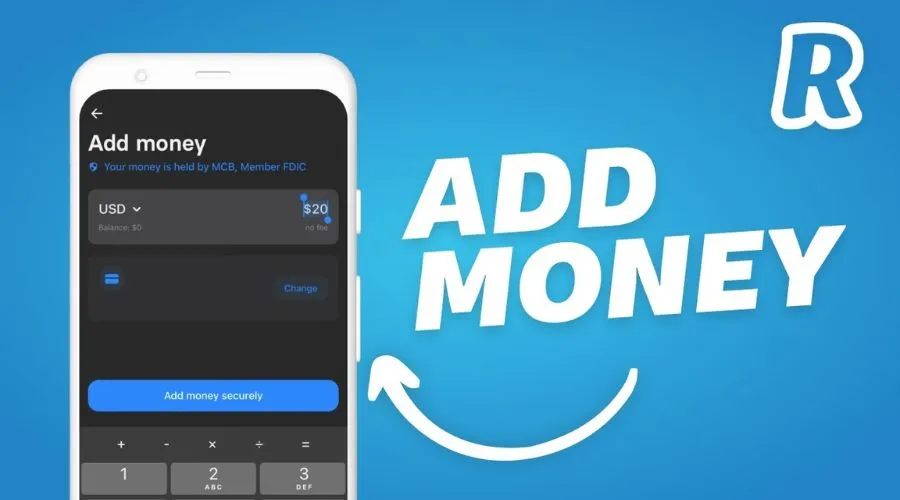

Step 3: Add Funds to Your Revolut Account

With your account set up and verified, it’s time to add funds to your Revolut account. This can be done through various methods, including bank transfers or debit/credit card payments. Revolut provides a range of options to suit your preferences, ensuring convenience and flexibility.

Step 4: Order and Activate Your Revolut Travel Card

Once your account is funded, you can order your Revolut Travel Card directly from the app. The card will be delivered to your registered address, and you’ll receive a notification when it’s on its way. Upon its arrival, activate the card through the app to start using it for your travel needs.

Step 5: Load Your Revolut Travel Card with Desired Funds

After activating your Revolut Travel Card, load it with the desired amount of funds. Remember, you can load multiple currencies onto the card, allowing you to enjoy seamless transactions in different countries without worrying about exchange rates. The flexibility and convenience of the Travel Card empower you to make the most of your travels.

Step 6: Explore the World with Your Revolut Travel Card

With your Revolut Travel Card loaded and ready to go, embark on your global adventures with confidence. Use the card for everyday purchases, ATM withdrawals, or online transactions, knowing that you have a cost-effective and secure financial companion by your side.

Conclusion

The Revolut Travel Card is more than just a prepaid debit card. It’s a gateway to seamless and cost-effective financial management during your international travels. With its multi-currency functionality, competitive exchange rates, user-friendly mobile app, and robust security features, the Travel Card is revolutionizing the way we handle money abroad. By leveraging the power of the Travel Card, you can bid farewell to traditional banking limitations and enjoy a world of financial freedom on your global adventures. So, take the first step and embark on a journey with the Travel Card, and unlock the full potential of your travels today. Visit the official website Trendingcult for more.