In today’s fast-paced and digitally-driven world, managing your finances effectively is more important than ever. Whether you’re saving for a dream vacation, paying off debts, or simply aiming to achieve your long-term financial goals, having a clear and comprehensive budgeting plan is crucial. That’s where Revolut’s Best Online Budget Planner comes in. Revolut, a leading global financial technology company, has revolutionized the way we handle money by providing innovative digital banking services. Their Online Budget Planner is a powerful tool designed to empower individuals, families, and businesses to take full control of their finances and make informed decisions. With Revolut’s Best Online Budget Planner, you can say goodbye to complex spreadsheets and manual calculations. This intuitive and user-friendly platform allows you to effortlessly create and customize budgets that align with your financial goals and lifestyle. By connecting your Revolut account, you gain real-time insights into your income, expenses, and savings, providing a holistic view of your financial health. Read the following article to learn more about the best online budget planner, online analytics software and cheap budget planner subscription.

Understanding the Need for an Online Budget Planner

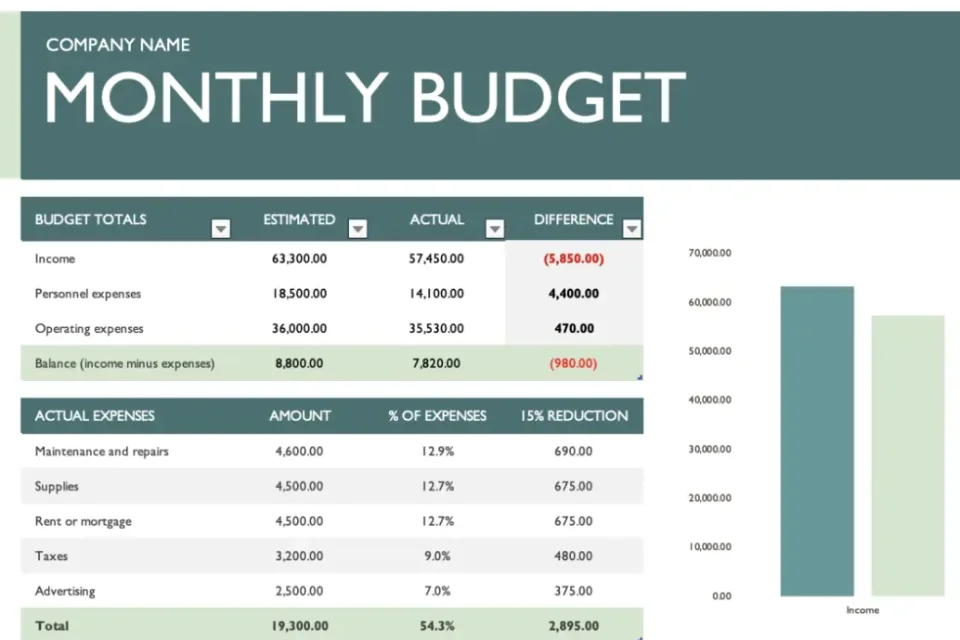

The best online budget planner on Revolut addresses the need for a centralized and user-friendly platform to track and manage your finances. Traditional budgeting methods often involve complex spreadsheets and manual calculations, which can be time-consuming and prone to errors. Revolut’s Budget Planner streamlines the process, providing real-time insights into your income, expenses, and savings.

1. Effortless Budget Creation and Customization

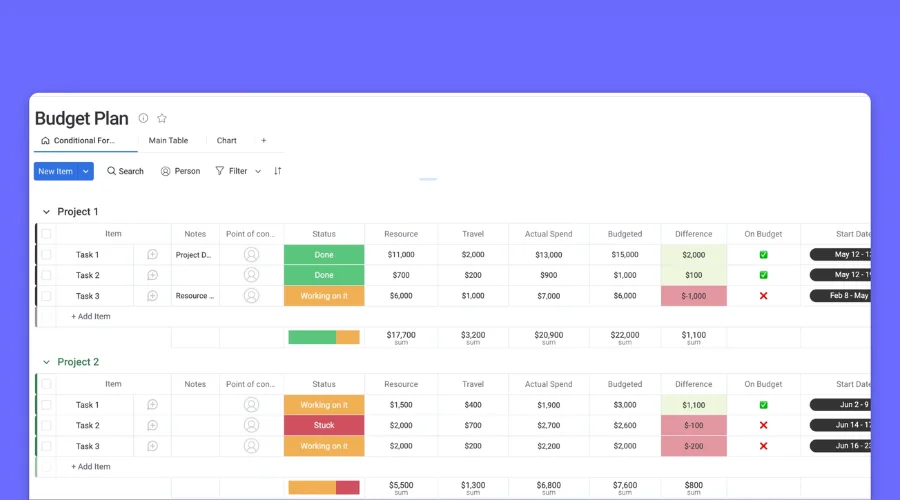

Revolut’s Best Online Budget Planner offers an intuitive and user-friendly interface that makes budget creation and customization a breeze. With just a few clicks, you can set up personalized budgets based on your financial goals and lifestyle. Whether you want to allocate funds for groceries, transportation, entertainment, or any other category, the platform allows for seamless customization.

2. Real-Time Transaction Tracking and Categorization

A standout feature of Revolut’s Budget Planner is its ability to automatically categorize transactions. This feature eliminates the need for manual input and helps you gain a clear understanding of your spending habits. The platform intelligently organizes expenses into various categories, making it easy to identify areas where you can potentially save money.

3. Detailed Spending Insights and Recommendations

Revolut’s Budget Planner goes beyond basic expense tracking. It offers comprehensive spending insights and personalized recommendations based on your financial habits. By analyzing your historical data and patterns, the platform provides actionable suggestions to optimize your budget. It empowers you to make data-driven decisions and take steps towards financial improvement.

4. Goal Setting and Savings Tracking

Achieving financial goals often requires diligent saving. Revolut’s Budget Planner enables you to set savings goals and track your progress effortlessly. Whether you’re saving for a down payment on a house, a new car, or building an emergency fund, the platform helps you stay on track by monitoring your savings and providing insights into potential adjustments to reach your goals faster.

5. Seamlessly Syncs with Revolut Accounts

One of the major advantages of using Revolut’s Best Online Budget Planner is its seamless integration with your Revolut account. By connecting your Revolut account, you have instant access to your financial data within the budget planner. This synchronization ensures accurate and up-to-date information, allowing for real-time analysis and decision-making.

6. Security and Privacy

Revolut takes the security and privacy of its users seriously. The Best Online Budget Planner employs robust encryption and advanced security measures to protect your financial data. You can rest assured knowing that your personal information and transactions are safeguarded against unauthorized access.

7. Mobile App for On-the-Go Budgeting

Revolut’s Budget Planner is conveniently accessible through its mobile app, ensuring that you can manage your finances anytime and anywhere. This flexibility allows you to stay on top of your budget even when you’re on the move. The user-friendly interface and seamless navigation make it effortless to track your spending, adjust budgets, and receive real-time updates.

8. Collaboration and Family Budgeting

Revolut’s Best Online Budget Planner also offers collaborative features, making it ideal for families or couples who want to manage their finances together. The platform allows you to create shared budgets, set financial goals collectively, and monitor progress as a team. This feature encourages open communication and shared responsibility, strengthening your financial management as a unit.

9. Customer Support and Additional Features

Revolut provides excellent customer support to address any queries or concerns you may have about the Budget Planner. They offer comprehensive documentation, tutorials, and a responsive support team to ensure a smooth user experience. Additionally, Revolut continues to innovate and improve its services, frequently adding new features and enhancements to the Budget Planner based on user feedback.

Conclusion

Revolut’s Best Online Budget Planner offers a comprehensive and user-friendly solution for individuals, families, and businesses seeking to take control of their finances. With its intuitive interface, real-time transaction tracking, personalized insights, and synchronization with Revolut accounts, managing your finances has never been easier. By leveraging this innovative tool, you can make informed decisions, optimize your budget, and work towards achieving your financial goals. Experience the revolution in financial management with the best online budget planner on Revolut and unlock a brighter financial future. Visit Trendingcult for more information.