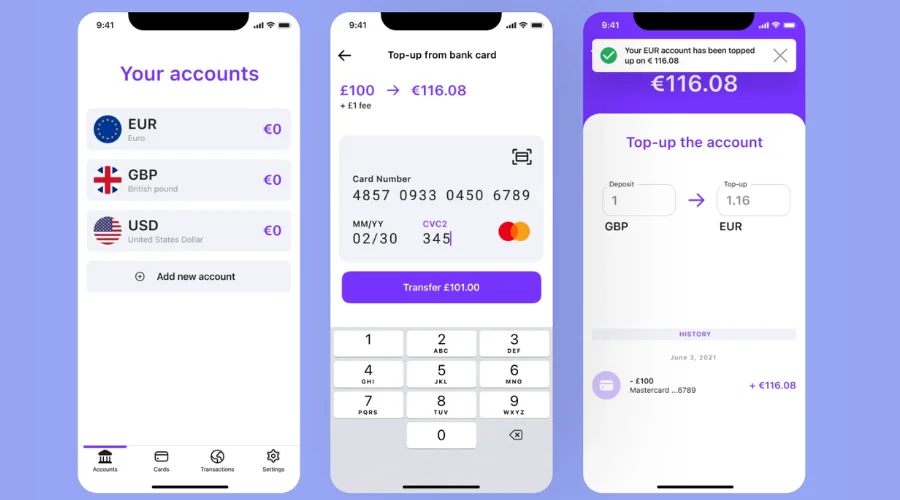

In today’s globalized economy, businesses need efficient and cost-effective solutions to manage their international transactions. Revolut, a leading financial technology company, offers a comprehensive suite of banking products, including multi-currency accounts for businesses. These accounts enable businesses to easily hold and manage multiple currencies in a single account, providing a seamless way to send and receive international payments. With fee-free international payments, real-time exchange rates, no minimum balance requirements, and round-the-clock customer support, Revolut’s multi-currency accounts for businesses empower businesses to transcend borders and thrive in the international marketplace.

Here are the top advantages of having a Multi-Currency Account with Revolut:

1. Unlock the Power of Fee-Free International Payments:

One of the standout features of Revolut’s multi-currency business accounts is the absence of fees for international payments. Whether you are making transactions in USD, EUR, GBP, or any other currency, Revolut does not charge any fees, allowing your business to save significantly on overseas transactions. This fee-free structure eliminates the need for businesses to worry about transaction costs eating into their profits, providing a competitive advantage in the global marketplace.

2. Real-Time Exchange Rates for Optimal Savings:

Revolut leverages live exchange rates when processing international payments, ensuring that businesses always receive the best possible deal. By accessing real-time exchange rates, businesses can avoid the inflated rates often imposed by traditional banks. This transparent and competitive approach enables businesses to optimize their foreign exchange transactions, saving money and increasing their overall profitability. With Revolut, you can have peace of mind, knowing that your international payments are being executed at the most favourable rates available.

3. Flexibility with No Minimum Balance Requirements:

Revolut understands that businesses’ cash flows can be unpredictable, especially in today’s rapidly evolving market conditions. That’s why their multi-currency accounts for business have no minimum balance requirements. This flexibility allows businesses to manage their funds without the burden of maintaining a specific balance, making it easier to adapt to changing financial needs. Whether you’re a small startup or a multinational corporation, Revolut’s multi-currency accounts for business can seamlessly accommodate your unique cash flow requirements.

4. Round-the-Clock Customer Support for Peace of Mind:

Revolut is committed to providing exceptional customer support to businesses around the world. With 24/7 customer support available in multiple languages, you can get assistance whenever you need it. Whether you have a question about a transaction, need help navigating the platform, or require technical support, Revolut’s knowledgeable team is there to assist you. This round-the-clock support ensures that your business operations are not disrupted, regardless of your location or time zone.

5. Centralize Your Reporting for Enhanced Financial Management:

In addition to its core features, Revolut’s multi-currency accounts for business offer a centralized reporting system that provides businesses with comprehensive insights and analytics. With this robust reporting functionality, businesses can stay on top of their financial data, make informed decisions, and effectively manage their international transactions. Revolut’s reporting tools provide businesses with a wealth of information, including analytics, audit confirmations, expenses, and monthly statements. By accessing these reports, businesses can gain valuable insights into their financial performance, identify trends, and make data-driven decisions to drive growth and efficiency.

Here are some additional details about Revolut’s multi-currency accounts for business:

- Supported currencies: Revolut supports 25+ currencies, including EUR, USD, GBP, CHF, CAD, AUD, JPY, and more.

- Inbound transfers: Revolut offers unlimited inbound transfers in EUR, USD, GBP, and CHF from anywhere in the world.

- Exchange rates: Revolut uses live exchange rates when processing international payments.

- Account fees: Revolut does not charge any fees for international payments or for holding multiple currencies in your account.

- Customer support: Revolut offers 24/7 customer support in multiple languages.

To open a Revolut multi-currency business account, businesses must meet the following requirements:

- Be a registered business

- Have a valid business email address

- Have a valid phone number

- Provide proof of business registration

- Provide proof of identity for the business owner or an authorized representative

Conclusion

Revolut’s multi-currency bank accounts for business offer a comprehensive solution for businesses looking to streamline their international transactions. With fee-free international payments, real-time exchange rates, no minimum balance requirements, and 24/7 customer support, Revolut empowers businesses to operate globally with ease. By simplifying the management of multiple currencies, Revolut enables businesses to save money, optimize their foreign exchange transactions, and focus on their core operations. Whether you are a small business or a multinational corporation, Revolut’s multicurrency accounts for business provide the tools you need to succeed in the global marketplace. Embrace the future of international banking with Revolut and unlock new possibilities for your business. If you are looking for a convenient, flexible, and cost-effective way to manage multiple currencies, a multi-currency account for individuals may be a good option for you. For more information, visit Trendingcult.