Revolut is a leading financial technology company that has revolutionized the way we handle our finances. With its innovative mobile application and cutting-edge features, Revolut offers a seamless and convenient way to send and receive money across borders. International money transfers, a fundamental aspect of Revolut’s services, provide users with a hassle-free solution to securely transfer funds to friends, family, or businesses in different countries. Gone are the days of traditional bank transfers, with their complex procedures and exorbitant fees. Revolut has emerged as a game-changer, providing users with an efficient and cost-effective platform for international transactions. Whether you need to send money for personal reasons, make payments for goods and services, or support loved ones abroad, Revolut’s international money transfer service offers a convenient and reliable solution.

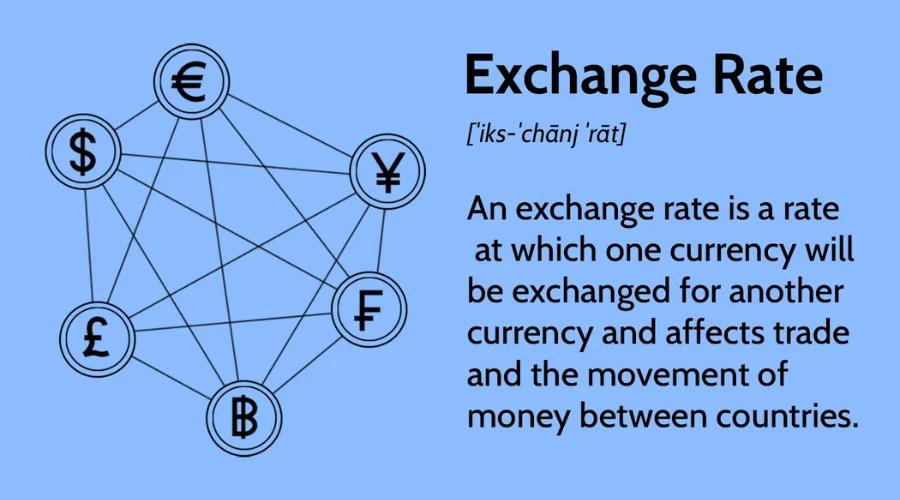

One of the standout features of Revolut is its competitive exchange rates. With traditional banks often charging significant markups, Revolut ensures that you get the best possible rates without hidden fees. The platform utilizes real-time rates, allowing you to make transactions at the exact interbank rate, ensuring transparency and saving you money in the process. Read the following article curated by Trendingcult to learn more about International money transfers, transfer money internationally and the best international money transfer.

Understanding International Money Transfers

International money transfers refer to the process of sending money from one country to another. These transfers can be made for various reasons, including personal payments, business transactions, remittances, or simply supporting loved ones abroad. Traditionally, international money transfers were primarily conducted through banks, which often involved complex procedures, high fees, and unfavourable exchange rates. However, with the rise of fintech companies like Revolut, the landscape of international money transfers has significantly evolved.

The Rise of Revolut and its International Money Transfer Service

Revolut is a prominent financial technology company that has revolutionized the way we manage our finances. Its mobile application offers a range of services, including international money transfers, which provide users with a seamless and cost-effective solution for transferring funds across borders. By leveraging cutting-edge technology, Revolut has made international money transfers faster, more transparent, and more convenient.

1. Competitive Exchange Rates

One of the key advantages of using Revolut for international money transfers is the competitive exchange rates it offers. Unlike traditional banks, which often charge hefty markups, Revolut allows users to make transactions at the interbank rate, the most favourable rate available. This transparency ensures that users receive the best value for their money and avoid hidden fees.

2. User-Friendly Interface

Revolut’s user-friendly interface sets it apart from traditional banking systems. Sending money abroad is as simple as a few taps on your smartphone. The app guides you through the process, ensuring that even those new to international transfers can navigate it effortlessly. Additionally, Revolut offers multiple payment options, including bank transfers, card payments, and instant transfers between Revolut users, enhancing flexibility and convenience.

3. Enhanced Security Measures

When it comes to international money transfers, security is of utmost importance. Revolut recognizes this and has implemented robust security measures to safeguard user information and transactions. The platform utilizes advanced encryption technologies and adheres to strict security protocols to ensure the safety of funds during transfers. With Revolut, you can have peace of mind knowing that your money is protected.

4. Tracking and Notifications

Revolut’s app provides users with features that allow them to track their transactions in real time. Instant notifications keep users updated on the status of their transfers, ensuring transparency and peace of mind. Additionally, the app offers real-time balance updates, enabling users to have a comprehensive overview of their financial activity.

5. Financial Management Tools

In addition to international money transfers, Revolut offers a range of financial management tools. These tools empower users to manage their finances effectively while making international transactions. Features such as budgeting tools, expenditure categorization, and spending analytics help users gain insights into their spending habits and make informed financial decisions.

Conclusion

International money transfers are an integral part of today’s globalized economy. The advent of fintech companies like Revolut has transformed the landscape of cross-border transactions, providing users with convenient, cost-effective, and secure options. With competitive exchange rates, a user-friendly interface, robust security measures, and additional financial management tools, Revolut has established itself as a leader in international money transfers. Embrace the convenience and efficiency offered by Revolut and experience a seamless and secure financial experience like never before. Visit Trendingcult for more.