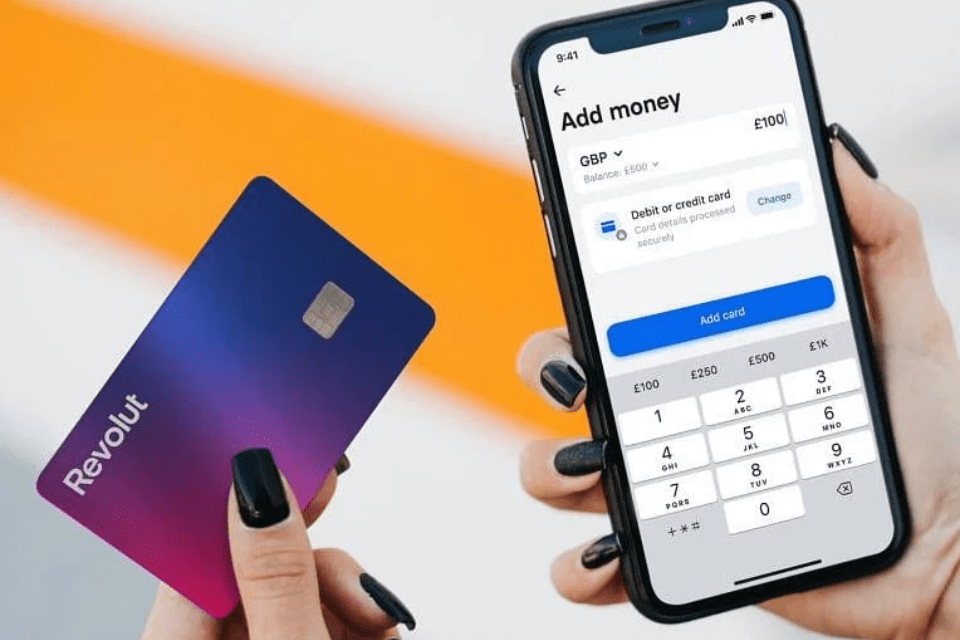

Financial transactions are now easier and easier than ever in the fast-paced world of modern business, owing to the emergence of creative financial technology firms. RevolutRevolut is one such innovator in the field of business financing. A variety of financial services, such as the Revolut Business Debit Card and prepaid business cards, are provided by RevolutRevolut.

Revolut Business Card: A Game-Changer in Business Finance

The Revolut Business Card, often referred to as the Revolut Business Debit Card, is a line of credit intended only for use by companies. This card gives company owners and entrepreneurs a flexible and safe method to handle their cash, which empowers them.

Revolut Business Debit Card Features:

Several aspects distinguish the Revolut Business Card from conventional business banking.

Multi-Currency Support:

The Revolut Business Card’s capacity to store various currencies is one of its most notable features. Businesses that deal internationally will find this feature very useful since it saves them money on currency conversion costs.

Real-time Expense Tracking:

Users may keep an eye on their spending in real time using the card’s integrated mobile app. This feature makes it easier for firms to keep a close eye on their spending, which promotes improved financial management.

Expense management:

Businesses may streamline bookkeeping and guarantee financial transparency by classifying and labeling costs with the Revolut Business Card.

Team Card Access:

Organizations are able to provide their employees with numerous Revolut Business Cards, each with individually adjustable spending caps. For bigger companies, this tool makes spending management easier.

Vendor connections:

Revolut makes it simpler for companies to sync their financial data with their accounting systems by providing connections with well-known accounting software.

The Revolut Business Card’s advantages

Cost-Effectiveness:

The Revolut Business Card does away with a number of expenses related to traditional business banking, such as transfer fees, hidden costs, and foreign exchange fees. For corporations, this results in huge cost reductions.

Financial Flexibility:

Businesses may function globally without worrying about currency translation or unforeseen expenses because of the multi-currency capability and real-time spending tracking.

Enhanced Security:

To guard cardholders against fraud and unauthorized transactions, Revolut employs state-of-the-art security measures. For extra protection, customers may now rapidly freeze and unfreeze their cards using the mobile app.

Streamlined Expense Management:

By lowering the administrative load and encouraging effective financial practices, the Revolut Business Card streamlines expense monitoring and management.

Prepaid Cards for Business: Expanding Financial Options

RevolutRevolut provides prepaid business cards in addition to the Revolut Business Card. These prepaid cards offer a special set of benefits that are quite useful in a variety of business situations.

Adaptability and Guidance

Businesses may set spending limitations and distribute payments as required with prepaid cards. This is especially helpful for businesses that have strict budgetary guidelines or that have to provide staff money for certain expenses, like travel or client entertainment.

Enhanced Safety

The financial records of businesses are further secured via prepaid cards. As they are not connected to a conventional bank account, there is less chance that private financial data may be accessed without authorization. Additionally, company owners may rest easy knowing that if a prepaid card is misplaced or stolen, the related money is usually safeguarded.

Monitoring Expenses

Prepaid business cards provide capabilities for tracking expenses, such as the Revolut Business Card. These technologies provide organizations the ability to keep a close eye on their finances, spot patterns, and track expenditures.

Effects on Enterprises

Businesses all around the world have been greatly impacted by the use of prepaid cards and the Revolut Business Debit Card.

Worldwide expansion

Businesses may expand abroad with ease thanks to the Revolut Business Card’s multi-currency capabilities. This feature makes it easier for firms to conduct cross-border trade by opening access to new markets.

Savings on Costs

Businesses save a lot of money thanks to RevolutRevolut’s clear exchange rates and elimination of banking fees. The company’s financial stability may be strengthened or expansion efforts may be funded with these savings.

Economic Effectiveness

Businesses’ financial procedures are streamlined by RevolutRevolut’s real-time spending tracking and management capabilities. Better financial decisions, more effective planning, and lower administrative costs are all a result of this efficiency.

Control and Security

Businesses feel in charge of their funds thanks to Revolut Business Card security features and prepaid business cards. This safeguard encourages financial stability and lowers the possibility of fraud.

Conclusion

RevolutRevolut’s cutting-edge products, such as the Revolut Business Debit Card and prepaid business cards, have completely transformed the company financing industry. With features like multi-currency support, real-time spending monitoring, cost reductions, and improved security, these financial solutions provide firms with more control. These tools have an influence on enterprises because they make it easier to expand internationally, cut expenses, increase financial efficiency, and provide more security and control.

Prepaid cards for business and other alternatives like the Revolut Business Debit Card have become essential tools for companies navigating the constantly changing financial landscape. Businesses may better position themselves for success in a market that is becoming more dynamic and competitive by adopting these technologies. For more information on Business debit cards visit the official website of Trending cult.

FAQ

Is there anything I can do with my company debit card?

The conditions and regulations established by your bank or other financial institution, together with the kind of business account you own, govern how you use a business debit card.

Is it possible to take cash out with a company debit card?

At ATMs, you may often take out cash with a corporate debit card; however, there can be daily withdrawal restrictions in place.

To open a company debit card, what is required?

- Business Entity

- Business Bank Account

- Business Documentation