In today’s interconnected world, managing finances across borders and currencies has become a vital part of every business life. You’ve probably experienced the hassles and extra expenses associated with dealing with several currencies no matter what your profession or your requirement has been. When it comes to financial management, Revolut is a game-changer since it provides a novel answer. In this article, we’ll go over the many ways in which Revolut’s Multi-Currency Accounts may help you out, from lowering your currency conversion fees to streamlining your overseas transactions and beyond.

Understanding the Revolut Multi-currency account

1. Definition and Purpose

Customers may manage and store many currencies in one account using Revolut Multi-currency account, a digital banking solution. The primary objectives of this account are to reduce currency translation costs, streamline international transactions, and provide users with the flexibility to send, receive, and spend money in a number of different currencies.

2. How it Works

Users get access to a virtual wallet with the capacity to store numerous currencies when they open a Revolut Multi-currency account. It is an affordable option for expats, overseas customers, and companies doing business with foreign suppliers because users may convert money instantaneously at the genuine exchange rate.

3 Impact on the Financial Services Industry

The introduction of the Revolut Multi-currency account has had a big impact on the financial services industry. Because of the increased threat posed by fintech companies like Revolut, traditional banks are being forced to enhance their digital capabilities, reduce expenses, and provide better services.

Benefits of Revolut Multi-currency account

Currency Exchange at Competitive Rates

Revolut’s Multi-currency account allows users to hold and exchange money in multiple currencies at competitive rates. This is particularly advantageous for frequent travelers or individuals who engage in international business transactions. Traditional banks often charge high foreign exchange fees and offer less competitive exchange rates. With Revolut, users can save a significant amount of money on currency exchange by taking advantage of the real exchange rates offered during weekdays, without any hidden fees.

Global Spending without Transaction Fees

Another key benefit of Revolut’s Multi-currency account is the ability to make international transactions without incurring additional fees. Traditional banks typically charge fees for international card usage or ATM withdrawals. Revolut, on the other hand, offers fee-free spending in over 150 currencies. This can result in substantial savings for individuals who frequently travel or shop online from international vendors.

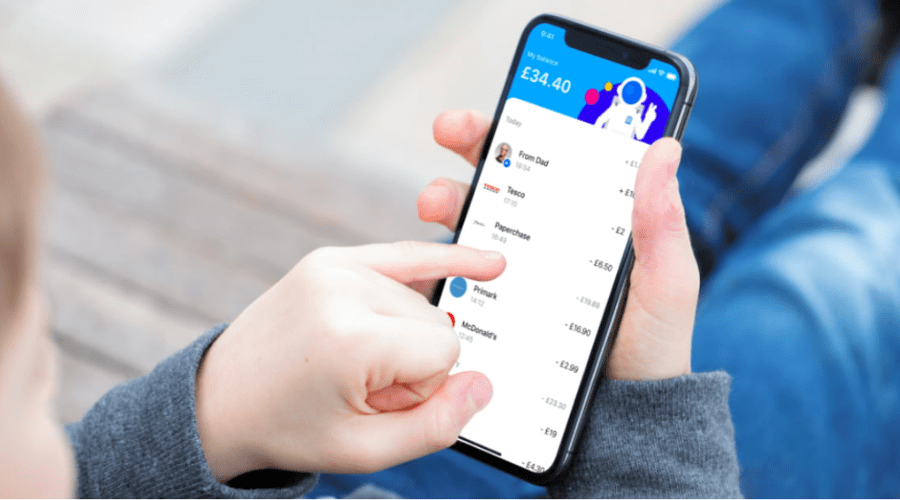

Instant Payment Notifications

Revolut’s Multi-currency account provides users with instant notifications for all account activities. This includes notifications for card transactions, ATM withdrawals, direct deposits, and more. This real-time feature enhances security, as users can immediately detect any unauthorized or suspicious activities and take necessary actions to protect their accounts.

Virtual and Physical Cards

Revolut offers both virtual and physical cards to its users. Instantly accessible on the mobile app, the virtual card can be used for purchases made in cyberspace. The ability to order physical cards for use in person makes this a flexible solution for both online and offline purchases. Users can also customize their physical card’s design.

Global ATM Access

Users of Revolut’s Multi-currency account have access to a global network of ATMs. Revolut lets its members take out cash from ATMs abroad for free, subject to a monthly limit, while some traditional banks impose outrageous fees for such transactions. This is particularly beneficial for travelers who may need cash in foreign countries.

Key Features of Revolut’s Multi-currency Account

Real-time Exchange Rates:

Revolut offers real-time exchange rates at interbank rates, which are the most competitive rates available. This means that users can convert their money between currencies without incurring the high conversion fees that traditional banks often impose. This feature saves money and provides transparency in currency conversion.

Budgeting and Analytics:

Revolut’s Multi-currency account offers advanced budgeting tools and financial analytics. Users can set monthly budgets for various expense categories and track their spending in real time through the app. This helps in managing finances more efficiently and making informed financial decisions.

Security and Control:

Security is a top priority for Revolut. Users have control over their account and card settings. They can freeze and unfreeze their card instantly from the app if it’s lost or stolen. Additionally, they can set transaction limits, enabling a greater level of security.

Vaults and Round-ups:

Revolut allows users to create “Vaults” to save money for specific goals or purchases. The “Round-up” feature automatically rounds up each transaction to the nearest whole number and saves the spare change in a designated Vault. This makes saving effortless and helps users reach their financial goals more quickly.

Conclusion

In conclusion, To sum up, the Revolut Multi-currency account is a revolutionary financial tool that has revolutionized the way both individuals and companies handle their money. Revolut is leading the way in the multi-currency banking revolution with its affordable currency conversion, multi-currency wallets, and easy international transfer alternatives. For more information about multi-currency money transfer, visit the official website of Trendingcult